Our Performance

Resnn Investments LLC is a Financial Advisor / Registered Investment Advisor located in Highlands Ranch, Denver CO.

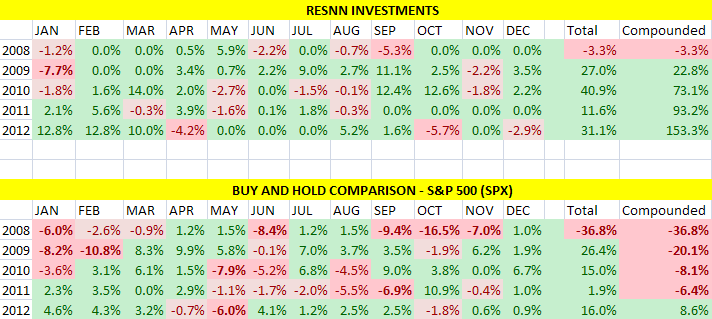

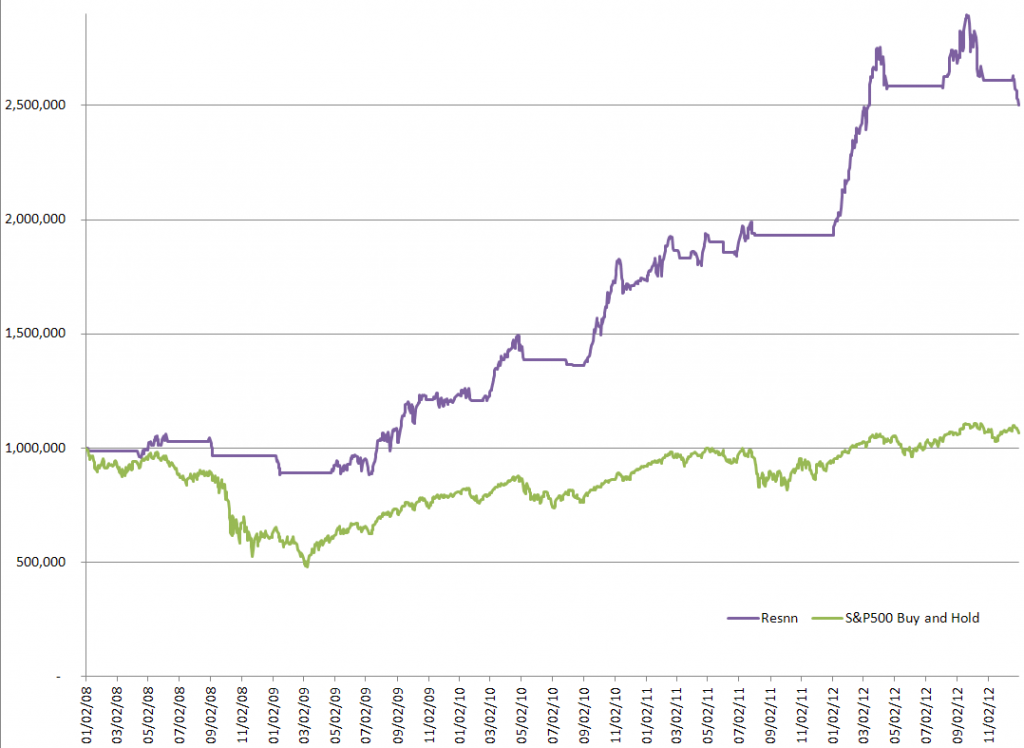

Since 2008 through 2012 (5 years), Resnn earned over 153%, while the S&P500 earned 8.59%. It did so with a beta of 0.195, creating an incredibly diversified, low correlated investment relative to the overall market.

How did your investments do?

“The strategy excels most in down years where most investors feel the full pain of the market’s decline … In 2008, while we only lost 3.3%, the S&P500 lost 36.8%.”

Draw down was minimal as shown by our monthly performance figures below. Notice month by month the performance difference between Resnn’s flagship strategy (top grid) and the S&P 500 (bottom grid).

In our historical tests the results were equally as impressive, the Resnn strategy beat the Nasdaq 34 out of the past 40 years with a positive close in 33 out of 40 years with incredible risk control.

In 2000-2002 while the Nasdaq lost over 78.4%, our model lost only 13.4%. In October 1987 when the Nasdaq lost 27.23% in one month, our model lost only 1.55%.