tomorrow should be critical, a technical analysis primer

Today was a productive day in the market, prices moved up and tested most of the smaller declining moving averages (5,10,17,20) and although they closed below all the averages, it was a good start.

I still have a skeptical stance at this point and in fact added to my short positions intraday today, but the latter half of the day was certainly strong enough for me to question my conviction.

Tomorrow will be a critical day for the market since in order to continue to the upside we have a number of hurdles to pass which are incredibly close.

What hurdles you say …

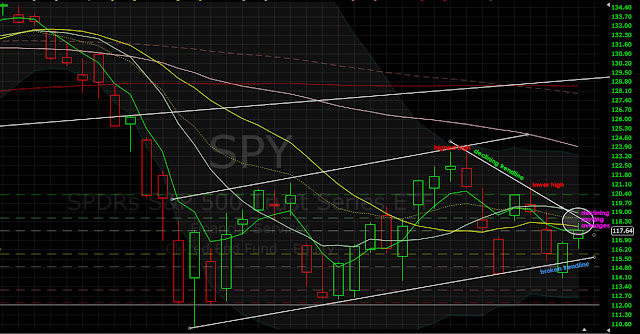

I have attached a chart below of SPY (the S&P500 etf) showing the high back in late July all the way up through today. Note, please click on the chart to see a zoomed version (and click back … to come back to this text after viewing the chart)

1) The first and possibly most important short term hurdle if this uptrend is to continue is for price to get above the short term moving averages with conviction. Many traders use moving averages in their trading decision and generally speaking, being above the moving averages is bullish, and below is bearish (I am grossly over-simplying here, but the bottom line is that getting the price over the moving averages is critical for an uptrend to stay healthy. To identify the moving averages in the chart below, you will see a number of squiggly lines just above today’s closing price and to the left of the purple text.

My assumption for tomorrow is that IF we are going to continue this upside movement, the market will have to gap up OVER the moving averages and then we just need to hold above them (as support) throughout the day. If the market does not gap up, I assume we will have a few more days of churning or downside movement before testing these moving averages again. In the graphs below, I have circled the moving averages and written in pretty purple 🙂 to identify them. You can see that the closing price is directly below them.

2) Yesterday I became bearish when the lower trendline (blue ink in the chart) was broken that the market has been obeying over the past month. A broken trendline can be an indication that more downside is coming as traders rely on these trendlines to make trades and set stops outside of them. Once a trendline is broken, their confidence in that line is also broken and therefore traders will not purchase at that ‘magic’ number again, they will let prices fall below it. So what was once support, is most likely no longer support. If you look at the chart below, you can see that for the entire month of August, prices would touch this lower trendline and then bounce from there up … until yesterday. With that said, the fact that it went below the line, but was able to close above it and further hold above it today lessens the bearishness of the signal. A broken daily trendline has intermediate term consquences.

3) lower highs confirms the intermediate trend is bearish – The last upleg attempt was thwarted (on 9/8/2011) before we were able to make a new higher high … which is critically important for an uptrend to continue. By definition, an uptrend means that we continue to have higher highs and higher lows, but if you look at the chart below we have not been able to accomplish that. Look at the red ink, the highest high that we had in the past month was on 8/31 (notated on the chart as “highest high”) and we could not get up to that level again noted by the lower high on 9/8 (notated on the chart as “lower high”). We have to make a new higher high in order for the intermediate trend to become bullish, so short term we can be bullish, but currently on the intermediate term we are still bearish as a result of this.

4) Also confirming a bearish short term stance, we also butted against the declining trendline (notice green text in the chart below) today which is good that we are there, but bad in that we were not able to break the trendline. A gap over this will also be needed in order to put that resistance in the rear view mirror. This trendline if not broken will most likely mean that we will retest the lows over the coming week and in fact, quite possibly will mean a new lower downleg, so breaking this line is critical. This is a short term indicator, but one that must occur in order for the uptrend to continue.

You can see from all of this, that when analyzing the market, you really have to consider multiple time frames in order to evaluate the current situation. I break the price movement down into three time frames when evaluating the market: short term usually is 3-5 days, intermediate 2 weeks and long term 2 months. Right now, I see short term bearish, medium term neutral and long term bearish, but with the market volatility the way it is, things can change very quickly with all of this. In fact a gap over the moving averages will change my short term stance to bullish, and a new higher high will make my intermediate term bullish as well … so we could be close to going long 100%

It is important to note that when all three time frames give you the same signal (all bullish, or all bearish) … that is the time to get aggressive, when they are sending mixed signals you either want to stay out or go shorter term which means tightening your stops to protect long term capital.

Bottom line, we have a lot of hurdles to surpass in the coming days if this market is going to right itself and although I am becoming skeptical, I am not going to make any assumptions … i’ll let the market guide me.

hope you have a great evening!